Charitable Gift Annuities

Charitable gift annuities may interest you if you want to make a significant gift to the Society of the Little Flower and you want:

- Income for Life — at attractive payout rates;

- Tax Deduction Savings — a large part of what you donate is a deductible charitable gift;

- Tax-Free Payout — a significant portion of your payments is tax-free;

- Personal Satisfaction — knowing that your gift will benefit the Society for years to come.

You transfer cash or securities to the Society of the Little Flower and the Society pays you, or up to two annuitants you name, a lifetime annuity. The principal passes to the Society of the Little Flower at the end of the contract.

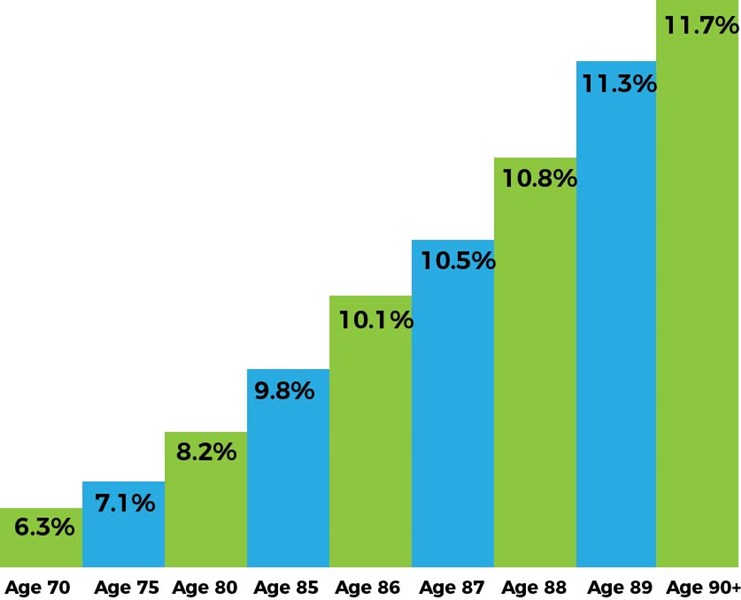

Single Life Rates of Return on a Society of the Little Flower Gift Annuity

Please call our office for payout rates below age 70 or for two-life or deferred rates. 1-888-996-1212

The above information is not intended to be specific legal advice. Please consult your consultant and/or attorney in all legal matters. Laws regarding contracts may vary in different states.

Charitable Gift Annuity FAQs

It is a legal contract between a donor and the Society of the Little Flower. The donor makes an unrestricted gift to the Society in exchange for the Society providing the donor and/or a loved one with fixed payments for life.

Our program provides our friends with an opportunity to make a significant gift to the St. Therese Endowment Fund. This fund provides essential support for Carmelite ministries and education programs, including the Seminary Education of future Carmelite Priests and Brothers so that they can unveil God’s love to future generations. At the same time, you and/or a loved one will receive fixed payments for life. Through a Gift Annuity, donors help the Society as well as provide a benefit to themselves.

First and foremost, it is a gift. Secondly, Little Flower Gift Annuities are safe and simple to establish. A Little Flower Gift Annuity also helps address concerns for receiving reliable future payments during one’s lifetime and provides relief from the responsibility of determining the future directions of the stock market, bond market, interest rates, and other investment considerations. As with any financial decision, we recommend that individuals consult with their financial advisor before deciding whether or not to create a Charitable Gift Annuity.

Your Little Flower Gift Annuity contract becomes a legal financial obligation of the Society of the Little Flower and is backed by all of the unrestricted net assets and resources of both the St. Therese Endowment Fund and the Society of the Little Flower. Investments of the St. Therese Endowment Fund include cash, money market funds, stocks, bonds, and mutual funds. Since our program’s inception over 70 years ago, we have made every payment on time.

Yes! A portion of each annuity payment you receive during your life expectancy is tax-free, and is not included as part of your total income when determining the taxable portion of your Social Security benefit. In addition, part of your gift is tax-deductible in the year you establish your annuity. Also, when you fund your Gift Annuity with long-term appreciated property (such as stocks or mutual fund shares) the reporting of your capital gain is spread out over your life expectancy. Finally, a Little Flower Gift Annuity allows you to make a gift that will provide a competitive payment rate.

Individuals receiving payments must be at least 60 years old at their closest birthday when the Gift Annuity is created (unless you are interested in a Deferred Annuity). Little Flower Gift Annuities can be funded with a gift of $1,000 or more.

Donors may create a Gift Annuity at the Society via a check, money order, or bank draft; or by transferring ownership to the Society of marketable property, such as publicly traded stock or mutual fund shares. (If owned for more than one year, gifts of appreciated securities provide additional tax benefits for donors.) Gifts may also be made via credit card with the addition of a fee. The Society’s Special Gifts staff would be pleased to share more information with you about ways to give.

To illustrate: if Mrs. Rice, whose closest age is 71, contributes $10,000 for a Little Flower Gift Annuity, at our current payment rates she will receive $650 each year for the rest of her life. Her payment is set at the time of her gift, is based on her age, and will never change.

A portion of Mrs. Rice’s annual payment will be tax-free for a period of years, and the balance will be taxable. Also, the gift portion of her $10,000 contribution is deductible in the year of her gift. Mrs. Rice can choose to receive her annuity payments annually, semi-annually, quarterly, or monthly, depending on her preferences and the amount of her Gift Annuity. Our Special Gifts staff can provide you with one or more free proposals to illustrate some potential scenarios for various gift amounts and ages.

In a Two-Life Joint Annuity, the annuity is initially made payable to both spouses. After the death of either spouse, the payment remains the same, but is made payable to the remaining spouse and continues for the rest of his/her life. Because it covers two lives, the payment rate is somewhat lower than for a One-Life Annuity, with the rates based on both persons covered.

Yes. In a Two-Life Successive Annuity, the annuity is initially made payable to the applicant for his/her life. After the applicant dies, the annuity is then made payable to the second annuitant for the rest of his/her life. Because this covers two lives, the payment rate is somewhat lower than for a One-Life Gift Annuity, with the rate based on the ages of both persons covered.

The Gift Annuity is created now, with payments beginning at a specific date in the future (such as your anticipated retirement date or 60th birthday). Payment rates for these annuities are higher and Deferred Gift Annuities also provide a substantial tax deduction in the year of the gift. The Special Gifts staff can provide you with free proposals to illustrate some potential scenarios for various gift amounts and ages.

Yes! A new contract may be created at any time. New payment rates, based on your closest birthday at that time, will be issued. This provides you with the opportunity to take advantage of the rates that are available as you get older. You may also create a Gift Annuity to provide payments to a loved one, such as your spouse, child, niece, etc., as long as they meet the minimum age requirement of 60.

No, due to the immediate tax benefits that donors receive, charitable gift annuities are irrevocable and cannot be refunded.

Please call Paula Tomsky in the Society’s Special Gifts Office, toll-free, at 888-996-1212. We will be pleased to provide you with additional information, including a personalized gift annuity proposal for you to consider and discuss with your financial advisor.

Give from your IRA and Receive a Lifetime of Payments

Thanks to recent legislation, those who are 70 ½ or older can now use a distribution from their IRA to create a gift annuity (certain rules apply).

For those who are required to take a Required Minimum Distribution from their IRA, this is a great way to help yourself, the Society of the Little Flower, and also enjoy some attractive tax benefits.

For further details on these great opportunities, call Paula in our Special Gifts Office at 888-996-1212 .

Interested in learning more?

Call the Special Gifts team at 1-888-996-1212, or complete our contact form below.

Society of the Little Flower, Office of Special Gifts

1313 N. Frontage Rd., Darien, IL 60561